PREPARATION

Each year thousands of small to mid-sized businesses are either not sold, or sold below their potential fair values, due to insufficient exit planning and failure to execute value-enhancing actions.

Preparing to sell a business is a complex, disruptive and time-consuming project. Business owners are usually totally immersed in their businesses and rarely have the time or the knowledge to properly prepare their business for sale.

Apart from the marketing phase, deliberate steps taken within preparation phase often create significant financial value for business owners that will be realized upon sale.

With proper preparation, you can save both time and money when working with attorneys and business brokers at the next phase of selling your business. Likewise, you can unlock hidden value and guard against surprises that often lower value and reveal risks to potential buyers.

Make the best use of your time by keeping focus on operating and growing your business - while we evaluate, organize and prepare your business for sale.

Preparation is undoubtedly the most critical phase in the entire selling process.

RISK TO BUSINESS VALUE

Here are just some of the risks that may materially impact your business valuation:

-

Incomplete or unreliable financial statements

-

Insufficient EBITDA to meet Prospective Buyer’s criteria

-

Level of dependence on Owners for sales and operations

-

Quality of management team

-

Customer concentration

-

Unrealistic valuation expectations

-

Historical revenue growth rates

-

Overly aggressive financial projections

-

Limited tangible assets for debt financing

-

Lack of segregation between business and personal assets

Identifying risks early can allow you to remedy problems and avoid surprises that lower value.

THE CLIENTS WE SERVE

We work with small to mid-sized privately held business with $7.5 million or more in annual revenues to prepare and execute an exit strategy designed to create additional value for their business within their timelines, budget and objectives.

We also closely partner with business brokers, investment banks and your other business advisors to provide them with “on the ground” partners to create and implement strategies, tools and tactics to improve value.

OUR SERVICES

We work with you before your business even goes on the market, by helping you prepare and position your business for the sale. We are not business brokers or attorneys, who normally handle many of the transactions, marketing and legal aspects related to selling a business.

You wouldn’t sell your home without first fixing structural issues, upgrading kitchens or baths, improving the landscape or professionally staging your home to make a great impression. Selling a business is more complicated, but the same principles apply.

As with real estate, the buyer and their bank require a home inspection to uncover problems or issues with the property. Smart home sellers often hire their own home inspectors to identify real and potential issues so you can remedy these issues before your home goes on the market. Failure to do so can result in offers far below what you believe is “fair market value.”

FUSION Strategic Partners act as your “business inspectors,” who will work with you to identify and uncover items that need attention prior to a sale. However, we don’t just identify potential risks or operational issues, we work side by side with you to help address these issues and create the strategies, tools and tactics that can make your business more attractive to potential buyers.

Potential buyers of your business won’t make an offer until they perform due diligence and look for both opportunities and risks.

CUSTOM DESIGNED PROFESSIONAL ENGAGEMENTS

We work with business owners and their advisors to identify specific strategies and tactics within the preparation phase that are expected to provide incremental business valuation within budgets and timelines.

Each business is unique, so we will first assess your needs, present you with a plan and then engage with you and others as appropriate to look for both risks and opportunities. Once these risks and opportunities are identified, we will roll up our sleeves and work with you to implement your plan to enhance the value of your business.

Each business is unique and requires a customize plan to enhance value.

WE WORK WITH YOUR TEAM OF ADVISORS

We are also willing and available to collaborate with your team of trusted advisors (lawyers, tax accountants, business brokers, investment bankers, senior managers, and other advisors) to help prepare for the sale of your business or provide consultation in critical business sale decisions.

Having FUSION Strategic Partners on your team of advisors during the selling process can add value and contribute to a smoother sale, saving you time and money.

We can help save you time and money.

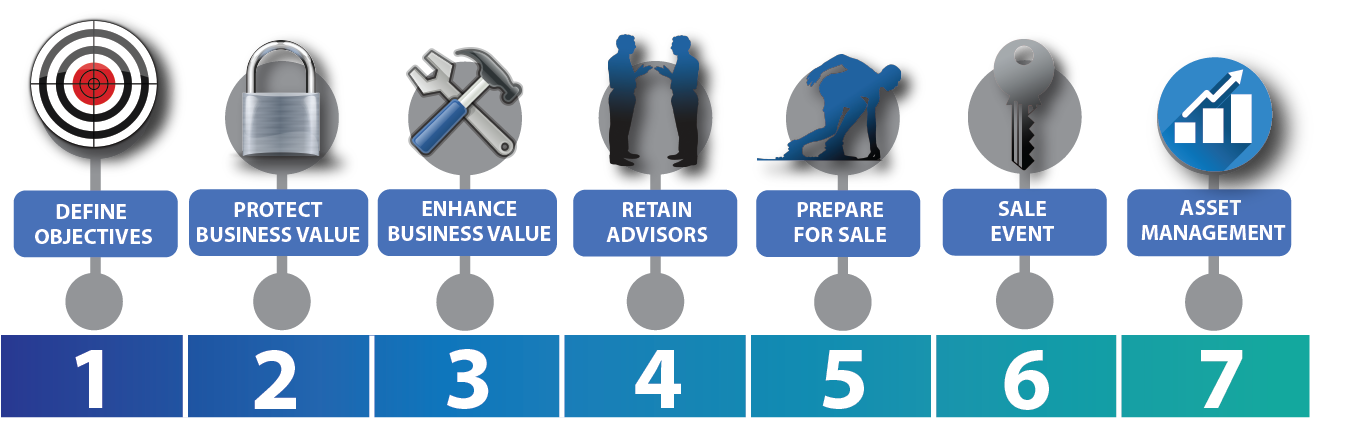

7 EXIT PHASES

There are commonly seven phases of selling and exiting your business, including pre and post-sale activities, that are designed to maximize your sales proceeds and protect your hard-earned assets.

While we primarily focus on the “pre-sale” phases, our planning process will encompass all phases in the selling cycle, so that you will be in a better position to work with your financial planner, attorney, tax and other business or estate advisors.

Phase 1: Define Business Owner’s Objectives & Prospective Exit Strategies

-

Financial Objectives

-

Potential Buyer Profiles (Employee, Financial, Strategic)

-

Immediate or Staged Exit

Phase 2: Protect Business Value

-

Estimated Current Value of Business (Range)

-

Risks to Business Valuation

-

Drivers of Business Valuation

Phase 3: Enhance Business Value

-

Identify Opportunities to Enhance Near-Term Business Value

-

Prioritize Identified Actions

-

Execute Agreed Upon Tactics

Phase 4: Retain Qualified Advisors for Sale Process

-

Business Transactional Lawyer

-

Tax Accountant

-

Other Trusted, Qualified Advisors

Phase 5: Preparing for Sale

-

Gathering & organizing important documents for prospective buyer due-diligence

-

Creating necessary documents for marketing of the business

-

Retain Business Broker or Investment Banker

Phase 6: Liquidity Event (Sale)

Phase 7: Management of Assets Post Sale

-

Asset Protection (Trusts)

-

Financial Planning for income/lifestyle needs

-

Estate Planning (Legacy, Gifting, & Charity)

FREQUENTLY ASKED QUESTIONS

Q: What does Fusion Strategic Partners offer that brokers, bankers, lawyers, accountants don’t?

A: FSP helps business owners identify opportunities within their business to enhance the likely near-term valuation as well as helping the selling business owner to compile all of the necessary records for the due-diligence process as performed by the prospective buyer.

Q: Why does a Seller of a business need Fusion Strategic Partners?

A: FSP offers proven expertise in preparing a business in the small to mid-sized market for sale. FSP purposely only engages one client at a time in order to provide our full attention and service to that client. We acknowledge and appreciate a business owner’s decision to sell a business after many years of hard work and sacrifice.

Q: Can the services provided by Fusion Strategic Partners increase the sale price of my business?

A: Yes. The purpose of our professional services engagement is to identify and focus on actions that can be taken prior to the sale which would add incremental value to your business.

Q: What other benefits does the business owner(s) receive by engaging the services of FSP?

A: By engaging FSP a business owner may continue to focus on the operation of their business while limiting the distraction caused by the preparation and sale of the business. FSP is able to coordinate with the Seller’s advisors.

Q: How long does it take to prepare a business for sale?

A: The length of time to prepare a business for sale will vary depending upon the required valuation, risks identified, condition of the financial statements, and the availability the important due-diligence related records. As a matter of prior experience, a Seller should expect that the time required to prepare a business for sale is ordinarily between 6 months and 24 months depending upon the readiness of the business.

Q: Is there one standard process in the preparation of a business for sale?

A: No. Each sale preparation process is customized for that businesses unique circumstances and objectives of the Seller.

Q: How confidential is the process of preparing a business for sale?

A: Maintaining confidentiality in the sale process is vital to protecting sensitive information from competitors or preventing employees or customers’ knowing about a sale transaction before it is completed. Confidentiality agreements and non-disclosure agreements (NDA) are legal documents used to protect confidentiality.

Q: What is the difference between business broker and an investment banker?

A: Business brokers ordinarily handle smaller sale transactions, less than $10 million in valuation and use online business listings and outreaches to prospective buyers to market your businesses for sale. While the investment banker often represents larger more complex transactions in valuations in excess of $10 million and markets the business in a controlled auction environment among several prospective buyers simultaneously within their exclusive network .

Q: What services does FSP not provide?

A: We do not provide legal, tax, accounting, or brokerage services. However, with our past experience we are able to work with your team of advisors in these areas to help you make important decisions.

David Japhet

ABOUT US

David Japhet, CPA is a co-founder of Fusion Strategic Partners with over 25 years of financial leadership focused on merger and acquisition transactions purposely designed to deliver sustainable financial results and enterprise valuation creation.

David’s specialties include strategic planning, restructuring, strategic alignment, business succession planning, change management, business performance improvement, debt negotiations, due diligence, post-merger integration, synergy capture, and risk management within the small to middle-market.

David’s buy and sell experience includes transactions within the market research, restaurant, security guards, alarm systems, real estate brokerage and transportation industries.

David enjoys helping business owners to plan for the next chapter of their life while ensuring that their business is best positioned for the ensuing owner.

While not working with business owners, David's pleasures include spending time in the great Maine outdoors and forming new memories with his 4 young adult children and granddaughter.